Malta’s Fintech Comeback: How Virtual Assets Could Reignite the Blockchain Island

Virtual Assets and Fintech: The Mediterranean Wave Malta Can Still Ride

By Ariadne Micallef, Valletta

On a sun-drenched Monday in May, the usual chatter at Nenu the Artisan Baker is no longer about ftira toppings but about Bitcoin. “My nephew just sold an NFT of a Maltese fishing boat for €4,000,” beams 68-year-old Ġanni from Sliema, proving that even nannu-next-door has caught the crypto bug. The anecdote is more than a novelty—it is a pulse check on a national transformation quietly unfolding beneath our limestone balconies.

Malta has long marketed itself as the Blockchain Island, yet the slogan has aged like cheap wine. After the 2017-2019 hype cycle, regulatory scandals and grey-listing bruised our reputation. Today, however, the sector is reinventing itself under the newly rebranded Virtual Financial Assets (VFA) framework and the EU’s Markets in Crypto-Assets (MiCA) regulation. Government insiders whisper that 2024 could be the year Malta reclaims its seat at the global fintech table—provided we move with Mediterranean agility rather than Mediterranean bureaucracy.

The numbers are persuasive. Finance Minister Clyde Caruana revealed in his May budget update that virtual-asset service providers (VASPs) already contribute €90 million annually in licence fees and corporate tax, surpassing the entire film-incentive scheme. More importantly, these companies employ 1,600 people—half of whom are Maltese graduates who would otherwise be eyeing London or Lisbon. At University of Malta’s newly opened Centre for Distributed Ledger Technologies, Dr. Joshua Ellul jokes that his classroom smells of pastizzi and ambition: “Our students aren’t building the next Dogecoin; they’re coding custody solutions that Deutsche Bank wants to buy.”

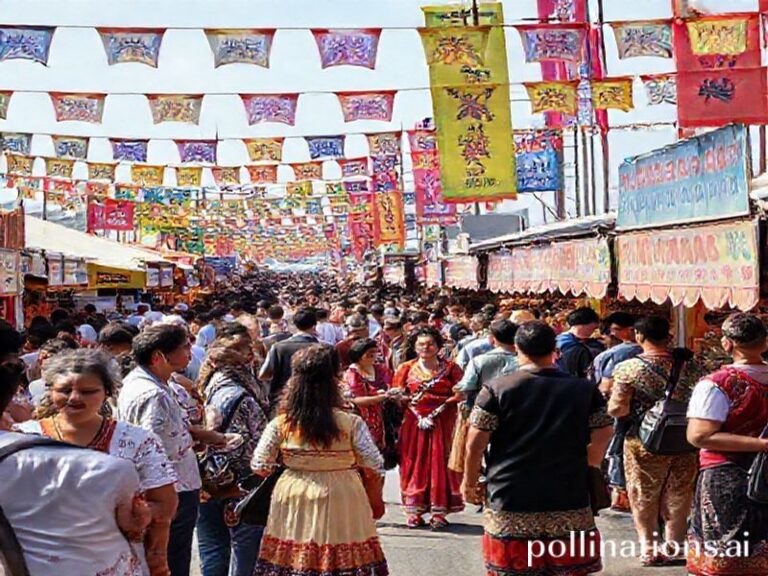

Cultural resistance remains. Older generations still associate crypto with money laundering and “those loud TikTok kids.” But fintech is slipping into the island’s social fabric in charmingly Maltese ways. Last month, the village festa of Żebbuġ featured a blockchain-powered tombola, where every ticket purchase was minted as an NFT—raising €22,000 for the church roof without the usual paper-chase. Meanwhile, band clubs in Għargħur accept Revolut donations, and fishermen in Marsaxlokk use stablecoins to pre-sell their lampuki catch to restaurants in southern Italy, dodging costly correspondent banks.

The community impact is most visible in Gozo. When the Azure Window collapsed in 2017, tourism took a hit. Now, a start-up called GozoChain is tokenising eco-tourism packages: visitors buy digital “GozoPasses” that fund rewilding projects in return for discounted diving permits. The model has already attracted 7,000 international visitors, injecting €1.2 million into local B&Bs and farmhouses that had been half-empty since COVID. Mayor David Apap Agius of Victoria proudly calls it “tech with a village soul.”

Yet challenges lurk beneath the azure surface. The Malta Financial Intelligence Analysis Unit (FIAU) still issues hefty fines for shoddy compliance, and EU regulators watch our every move like hawks circling Dingli Cliffs. Meanwhile, residential rents in St Julian’s have spiked 18 % as foreign fintech workers compete with locals. “We want innovation, not colonisation,” warns Labour MP Rosianne Cutajar, who is pushing for a quota on expatriate housing in new Special Economic Zones.

Still, opportunity outweighs anxiety. The country’s greatest asset isn’t its tax rate—it’s trust. Centuries as a trading post between continents have hard-wired a merchant culture that values handshake deals over 200-page contracts. That cultural capital, fused with nimble regulation and a 24-hour flight radius from every major European capital, could turn Malta into the Mediterranean’s answer to Singapore. The pieces are on the board: a multilingual workforce, a gaming industry already fluent in digital payments, and a diaspora willing to repatriate both skills and cash if the ecosystem feels fair.

As dusk settles over the Grand Harbour, a group of VFA executives sip Kinnie on the Upper Barrakka balcony. Behind them, the blockchain-powered lights of Valletta’s new year-round cultural programme flicker to life, funded partly by a tokenised bond issued last February. One delegate from South Korea turns to me and says, “You Maltese have something we can’t code: a story.” If we can keep that story authentic while embracing the virtual future, the Blockchain Island might yet become the Fintech Republic—where every citizen, from Ħamrun to Ħal Far, owns a slice of the next digital wave.