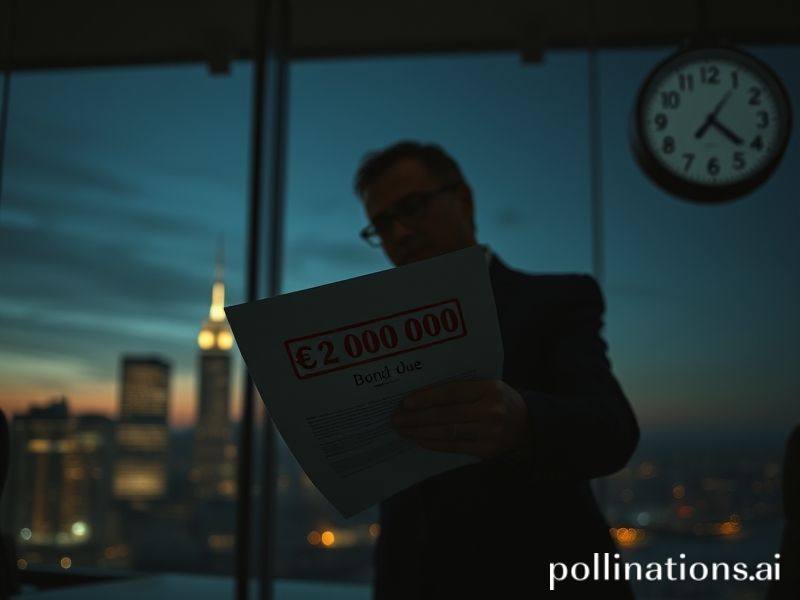

Silent Maltese firm faces €2m D-day: retirees, festa clubs and Gozo dreams on the line

Valletta’s narrow limestone streets echoed with whispers rather than the usual midday chatter yesterday, as a Maltese investment firm that vanished from public view twelve months ago suddenly resurfaced. The company—widely known on the island for bank-rolling glitzy St Julian’s rooftop bars and the long-awaited Gozo marina extension—has until 30 June to repay a €2 million bond issued to thousands of local savers. After months of unanswered emails, shuttered Rabat offices and a Facebook page frozen on last June’s festa fireworks, directors issued a terse statement promising “full transparency within days”. For many Maltese families, that pledge feels long overdue.

The bond, marketed in 2019 with glossy brochures quoting “5 % interest—backed by Maltese stone and sea”, was snapped up by retirees in Mellieħa, young professionals in Sliema and even parish clubs who parked festa savings in what looked like a patriotic investment. Roughly €1.3 million came from locals, the rest from Maltese expats in London and Melbourne eager to keep a stake in home. When coupon payments stopped last July, WhatsApp groups lit up with rumours: construction permits revoked, directors abroad, accounts frozen. The silence that followed felt particularly un-Maltese; on an island where a neighbour will shout your business across the balcony, corporate opacity is almost cultural blasphemy.

Yesterday’s short press release, emailed at 4.27 p.m.—just after the stock exchange closed—did little to calm nerves. Directors admitted that “liquidity challenges” linked to “delays in Gozo marina permits” had hit cash-flow, but insisted refinancing talks with a “leading Maltese credit institution” were “at an advanced stage”. Sources close to the Central Bank tell Hot Malta that no credit line has yet been approved, and the Malta Financial Services Authority has opened a supervisory review. Meanwhile, small investors like Maria Camilleri, a 62-year-old retired Valletta teacher, are left counting centimes. “That €15,000 was meant to help my grandson through university. Now we just want the truth,” she said, clutching a folder of dusty dividend cheques outside the company’s locked Qormi headquarters.

The cultural sting goes deeper than euros. Maltese society has long prized il-kunfidenza—trust built over pastizzi and village feasts. Bonds issued by local developers traditionally come with handshakes after Sunday Mass, not fine-print disclaimers. “When a Maltese company goes quiet, it feels like a family member ignoring you at a wedding,” explains Dr Antoine Borg, lecturer in sociology at the University of Malta. “It shakes our sense of community capitalism.” Facebook groups such as “Bond Holders Malta Solidarity” have swelled to 3,400 members overnight, sharing memes of festa pyrotechnics replaced by exploding piggy-banks.

The timing is politically sensitive. June marks not only the bond maturity but also the run-up to the Mnarja harvest feast, when rural families traditionally review finances after wheat sales. Government backbenchers worry that defaults could dent Labour’s reputation for protecting small savers. Opposition MP Mario de Marco called for a parliamentary inquiry, warning “ordinary Maltese should not pay for speculative mismanagement.” Economy Minister Silvio Schembri, however, urged caution: “Let’s await the refinancing plan before panic spreads.”

Local businesses already feel the chill. The Sliema wine bar that stocked directors’ favourite Merlot has seen unpaid tabs mount; the Għargħur band club postponed its feast fireworks order, fearing donations may be needed to help members who invested. Even the traditional imqaret stall outside Marsaxlokk church reports lighter tips. “People are holding onto coins in case they need them back,” vendor Ġanni told Hot Malta.

As sunset paints the Grand Harbour gold this evening, thousands of Maltese households will refresh their inboxes, hoping tomorrow brings more than promises. The company has promised a detailed plan by 15 June, leaving a tense fortnight where festa banners compete with bond-repayment countdowns. Whatever the outcome, the episode is a sobering reminder that on an island built on limestone and loyalty, silence can erode both faster than the salt-laden wind.