Malta Stock Exchange Stays Calm: What Minimal Equities Moves Say About Island Culture

Minimal tremors on the Malta Stock Exchange feel like a summer breeze in Valletta’s Upper Barrakka Gardens: pleasant, barely noticeable, yet whispering of bigger weather somewhere else. While global headlines scream about tech sell-offs and crypto crashes, the local equity board blinked in near-stillness this week—MSE index up 0.07 %, turnover a modest €240,000, no single ticker moving more than one per cent. For a country addicted to fireworks, festas and 3 a.m. Arguments about parking, the silence is almost un-Maltese. But that very calm tells a story about who we are, how we invest and what we value.

Walk into any village band club and you’ll hear louder volume on one guitar riff than the entire trading floor at the Exchange’s Tigne Point offices. The Maltese still prefer bricks, bonds and bank deposits to shares. Only 14 % of households directly own equities, Central Bank data show, compared with 55 % in the U.S. Or 33 % in Germany. Our grandparents hid savings under the mattress; our parents bought a flat in Sliema; we, the Instagram generation, crowdfund a cocktail bar in Gżira. Stocks? Too abstract, too “barra,” too foreign. The result: a €6 billion economy whose official market capitalisation is smaller than a single Nasdaq heavyweight.

Culturally, the bourse sits awkwardly beside the limestone parish. We celebrate saints’ days with petards that rattle stained glass, yet panic when share prices rattle 2 %. “In Malta, volatility is a dirty word,” laughs Stephanie Borg, chief market analyst at local brokerage Curmi & Partners. “Clients ring me if their dividend is one cent short, but they’ll gamble €50 on a cockfight in Rabat without blinking.” The joke carries truth: risk is tolerated when it’s communal, colourful and accompanied by a pastizz. The stock exchange offers none of the above.

Still, minimal moves mask subtle shifts under the surface. Bank of Valletta, the blue-chip bellwether, closed unchanged at €0.94, but daily volume doubled after rumours—since denied—of a foreign takeover approach. Malta International Airport inched up 0.5 % after passenger figures smashed 2019 levels; the tiny tick mirrors the roar of Ryanair jets over Ħaż-Żebbuġ fields. Even the much-maligned GO plc managed a 0.3 % gain despite a nationwide outage that turned TikTok feeds black for two hours. Traders call it “the festa effect”: forgive, forget, move on—just don’t expect fireworks.

The real action happens off-book. Family-held conglomerates—db Group, Tumas, Gasan—trade hands in private deals struck over Kinnie at the Corinthia. These transfers never reach the MSE ticker, yet determine whose crane next dots the skyline. “The index is calm because the drama is elsewhere,” explains lawyer-turned-commentator Claire Falzon. “When a €200 million hotel changes ownership in a side letter, it doesn’t show up in closing prices, but it shapes employment, traffic and coastal views.” In other words, the market is quiet because the marketplace is loud.

For ordinary citizens, flat equities mean neither jubilation nor despair. Pension funds, heavily weighted toward local sovereign debt, barely felt this week’s micro-blip. But the stagnation also denies households the wealth effect enjoyed by American or Nordic investors who see portfolios balloon and rush to buy new sofas. Here, the sofa was probably inherited from Nanna anyway. The cultural preference for tangible assets keeps housing prices resilient—good for owners, brutal for first-time buyers. Economists warn that low equity participation widens the gap between those who own land and those who can only lease airspace.

Could that change? Maybe. The new €50 million MICEX grant scheme lets small investors buy fractional shares without brokerage fees, mimicking France’s PEA plan. Government officials hope it nudges savers from 0.25 % term deposits into dividend-paying stocks. Early uptake is tepid—2,300 accounts opened, most by university students who think “dividend” is a TikTok filter. Yet momentum builds slowly, like a village festa that starts with one boy rattling a tambourine and ends with 20,000 people swaying to band marches at 2 a.m.

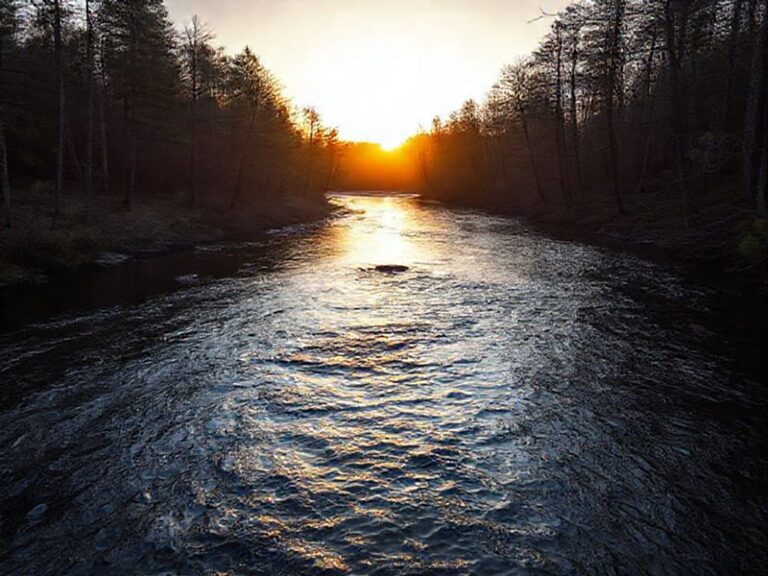

Until then, the MSE board will keep flickering like a candle in St. John’s Co-Cathedral: historic, serene, occasionally catching a draught. Minimal changes, maximal metaphors. And perhaps that is fitting for an island where time is measured not in trading sessions but in patron-saint seasons, where wealth is counted not in market cap but in cousins around the dinner table. The rest of the world may chase bull runs; Malta is content with a leisurely prickly-pear stroll. As long as the sun shines on the Grand Harbour and the pastizzi stay hot, a flat index feels less crisis, more blessing—an invitation to look up from our screens and notice the real blue chips: limestone balconies, turquoise waves and a community that still greets the bus driver by name.