Maltese Stock Market Slips as Six Big Names Tumble—What It Means for Your Wallet and Festa Plans

Six Equities Drag MSE Index Down as Maltese Investors Feel the Pinch

*By a Hot Malta Correspondent*

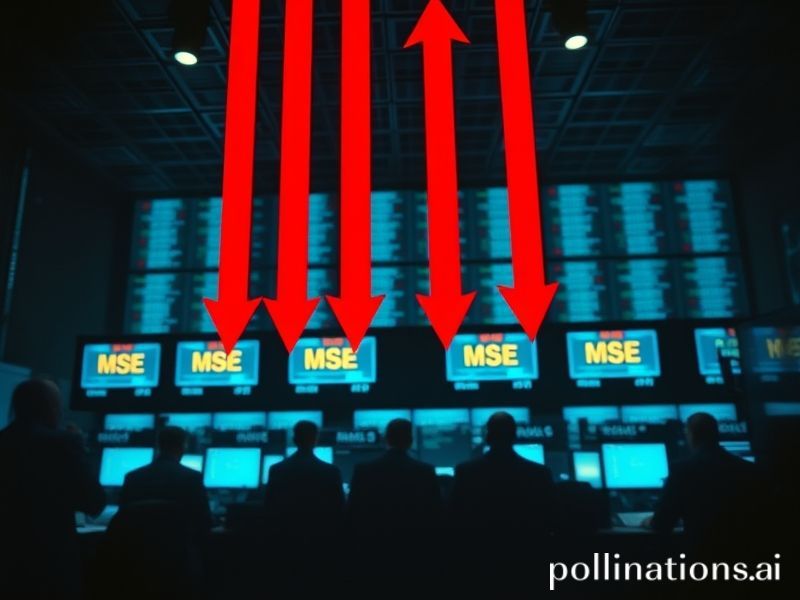

Valletta – The bells of the Stock Exchange Palace in Castille Place had barely finished chiming 9 a.m. Yesterday when the screens inside turned a familiar shade of red. Six locally heavy-weight equities—Bank of Valletta, HSBC Bank Malta, Malta International Airport, GO plc, RS2 Software and Plaza Centres—closed lower, pulling the MSE Equity Price Index down 0.64 % to 3,720.419 points. For the man on the Valletta bus, that decimal may sound trivial, but on an island where “everyone knows someone” who owns BOV shares, the tremor is felt faster than a summer power-cut in Gozo.

Malta’s market is minuscule—total capitalisation barely equals a mid-sized Milanese villa—yet its emotional footprint is colossal. Grandmothers still clip dividend coupons to fund festa fireworks; teenage traders in university residence halls swap tips over Kinnie and pastizzi. When six pillars sag at once, the whole village square seems to sigh.

Take the biggest drag, Bank of Valletta. Down 1.2 % to €1.15, the bank that financed many a first-time buyer in Żabbar or Żejtun saw €14 million in value evaporate—roughly the cost of two weeks of village festa seasons across Malta. “My nanna bought 500 BOV shares in 1992 so she could say she owned ‘a piece of the bank that gave her the home-loan’,” laughed Stephanie Saliba, 24, queuing at the BOV ATM in Republic Street. “She rang me just now asking if she should sell. I told her we’re long-term investors, not day-traders, but she still swears the red screen is an evil eye.”

HSBC Malta slipped 0.9 %, hurt by rumours—later denied—of looming EU banking-fee caps. Malta International Airport eased 0.7 % despite June passenger numbers surpassing 2019 levels; investors fear margin squeeze as jet-fuel surcharges scare off budget travellers. GO plc lost 1 % on fibre-roll-out costs; RS2, the payments-tech darling, shed 2.3 % after a broker note questioned its UK exposure; and Plaza Centres, owner of the Sliema shopping complex, dipped 0.5 % as consumers tighten belts after a 6 % food-price hike.

The broad-based nature of the fall is what spooked traders, explained Josef Muscat (no relation), head of research at local firm Rizzo, Farrugia & Co. “When defensive plays like the airport and telecoms join growth names in the red, it signals foreign funds are lightening exposure to frontier markets ahead of possible ECB rate hikes,” he said, sipping espresso from a plastic cup outside the Exchange. “Malta’s weight in global indices is 0.00-something, so even a €5 million sell order can swing prices.”

Yet numbers only tell half the story. Walk into any każin from Marsa to Marsaxlokk and you’ll hear the chatter: “Il-borża nieżla!” The phrase carries cultural weight akin to a weather forecast of impending ħamsin winds. It dictates psychology, wedding budgets, even the generosity of the communion-party cash envelope. Psychologist and columnist Dr. Anna Vella argues the market is Malta’s secular confession box. “We reveal our hopes anonymously through bids and offers, then collectively atone when prices fall,” she notes.

Yesterday’s drop also shadows national politics. The government is hawking a €350 million EU-funded metro study; critics say jittery markets expose investor fatigue with big-ticket promises. Opposition MP Jerome Caruana Cilia lost no time: “When six bellwethers sink, confidence in our economic stewardship sinks too,” he tweeted, hashtag #MSEmeltdown.

Still, veteran broker Alfred Said advises calm. “Remember 2009? We thought the world was ending. Those who held BOV at 80 cents now collect dividends higher than five-year government bonds,” he winks, adjusting the cufflinks shaped like Maltese crosses. His advice mirrors island resilience: “Keep a long horizon, enjoy the summer, and maybe buy shares instead of that third Airbnb.”

By closing bell, the square outside the Exchange had returned to its usual rhythms: tourists photographing the Triton Fountain, office workers debating whether to hit Happy Day at City Lights. The index may have dipped, but the communal pulse—equal parts caution and carnival—beat on. In Malta, after all, share prices rise and fall, but the festa must go on.