Maltese Restaurants Pay Just €4,500 in VAT: A Closer Look at the Economic and Cultural Impact

Restaurants Pay Just €4,500 a Year in VAT, Finance Minister Says

In a surprising revelation, Malta’s Finance Minister has announced that restaurants in Malta pay just €4,500 a year in Value Added Tax (VAT). This figure has sparked a flurry of reactions from various sectors, highlighting the complex interplay between business, culture, and community in our small yet vibrant island nation.

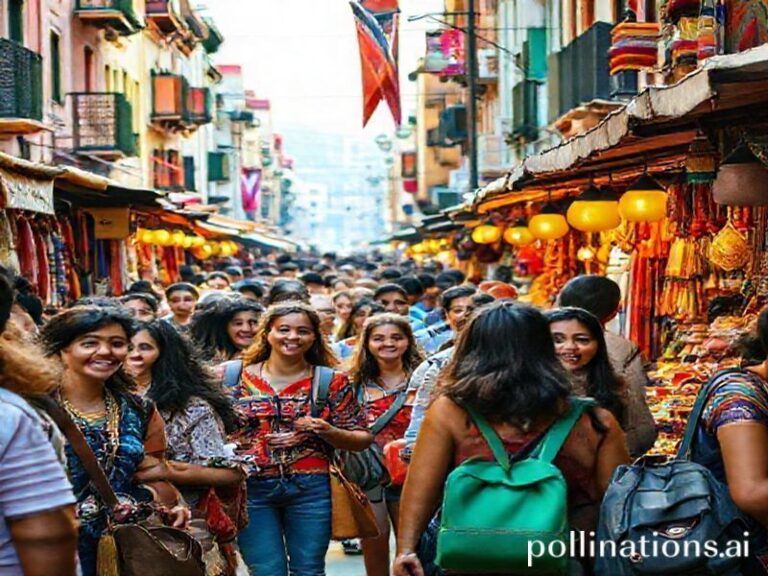

Malta, known for its rich culinary heritage and bustling tourism industry, relies heavily on its restaurants to attract both locals and international visitors. The revelation that these establishments pay such a modest amount in VAT annually has led to a broader discussion on the economic landscape and the role of the hospitality sector in the national economy.

The finance minister’s statement underscores the unique position of Malta’s restaurant industry. With a VAT rate of 18%, the €4,500 figure implies that the average restaurant’s taxable turnover is relatively low. This could be attributed to the seasonal nature of tourism, where many restaurants experience a significant drop in business during the off-season. However, it also raises questions about the overall profitability and sustainability of these businesses.

From a cultural perspective, restaurants are not merely places to eat; they are integral to Malta’s social fabric. They serve as communal spaces where families gather, friends meet, and traditions are celebrated. The Maltese cuisine, with its blend of Mediterranean flavors and historical influences, is a source of national pride. The modest VAT payments might reflect the challenges these establishments face in balancing the preservation of cultural heritage with the demands of a competitive market.

The community impact of this revelation is also significant. Many restaurants are family-owned and operated, contributing to local employment and economic growth. The €4,500 VAT figure suggests that these businesses may be operating on thin margins, which could have implications for their ability to invest in improvements, expand, or even survive economic downturns.

This news has prompted a re-evaluation of the support systems in place for the hospitality sector. While Malta’s government has implemented various initiatives to boost tourism and support local businesses, the VAT situation highlights the need for a more nuanced approach. This includes addressing the seasonal fluctuations in business, ensuring fair competition, and providing targeted financial assistance to struggling establishments.

For tourists, the VAT situation might not be immediately apparent, but it indirectly affects their experience. A vibrant restaurant scene is essential for a memorable visit, and the sustainability of these businesses is crucial for maintaining the quality and diversity of dining options available.

The Finance Minister’s revelation about the modest VAT payments by restaurants in Malta shines a light on the complex realities of the hospitality sector. It underscores the need for a balanced approach that supports the economic viability of these businesses while preserving the cultural richness they bring to our community. As Malta continues to evolve, it is essential to ensure that our restaurants remain a cornerstone of our national identity and economic prosperity.