Why Apple Pay Deposits Are the Obvious Choice for Malta in 2026

Why Apple Pay Deposits Feel Like the Obvious Choice in 2026: A Malta Perspective

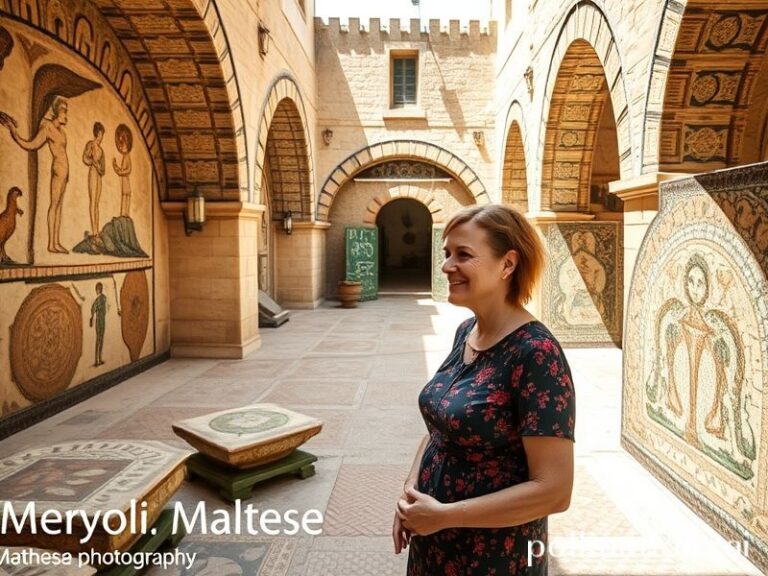

As we step into 2026, the technological landscape in Malta has evolved dramatically, and Apple Pay deposits have emerged as a frontrunner in the digital payment revolution. With a nation deeply rooted in its rich history and culture, the shift towards digital banking and seamless transactions is not merely a trend but a necessity that resonates with the Maltese way of life.

Malta, a hub of commerce and tourism, has always embraced innovation. The picturesque streets of Valletta and the vibrant markets of Marsaxlokk are now infused with the convenience of contactless payments. With the Mediterranean sun shining down on bustling cafés and shops, locals and tourists alike can enjoy the ease of making payments through their smartphones. The cultural significance of adopting such technology is profound, as it symbolizes a collective move towards modernization while maintaining the essence of Maltese hospitality.

In recent years, the adoption of digital payment methods has been accelerated by the COVID-19 pandemic, which forced many to reconsider traditional cash transactions. In 2026, as Malta continues to recover and thrive post-pandemic, the integration of Apple Pay into everyday financial practices feels not just convenient but essential. The service allows for instantaneous transactions, which is particularly beneficial in a tourist-dependent economy where speed and efficiency can significantly enhance the customer experience.

The community impact of Apple Pay cannot be overstated. Local businesses have begun to embrace this technology, recognizing that offering Apple Pay can attract a broader clientele. From artisan shops in Mdina to trendy eateries in Sliema, the ability to accept contactless payments is becoming a competitive advantage. For many small business owners, reducing the friction in transactions means increased sales and improved cash flow, which is vital for sustaining operations in a challenging economic environment.

The cultural shift towards digital payments reflects a younger generation that is tech-savvy and accustomed to convenience. This demographic, which includes a significant number of expatriates and digital nomads, thrives in an ecosystem where immediate gratification meets efficiency. For them, the idea of rummaging through wallets for change is as foreign as the notion of using a rotary phone. In this context, Apple Pay deposits feel like a natural progression, aligning with the values of speed, accessibility, and innovation that define this new era.

The security features of Apple Pay also resonate well with the Maltese populace, who are increasingly concerned about the safety of their financial information. With end-to-end encryption and biometric authentication, Apple Pay provides peace of mind that traditional payment methods often cannot. In a country that values its sense of community and trust, knowing that transactions are secure fosters a more strong relationship between consumers and businesses.

Additionally, the Maltese government has been proactive in promoting digital initiatives, creating an environment conducive to the growth of technologies like Apple Pay. Their support for fintech startups and investment in digital infrastructure signifies a forward-thinking approach that can only benefit the economy. This governmental backing, combined with public enthusiasm, creates a perfect storm for the widespread adoption of digital payment solutions.

As we navigate through 2026, the presence of Apple Pay deposits in Malta represents more than just a payment method; it embodies a cultural shift towards a more interconnected and efficient society. The blend of tradition and modernity, coupled with community benefits and governmental support, positions Apple Pay as the obvious choice for both locals and visitors alike. As Malta continues to embrace this digital future, one can only anticipate the exciting developments that lie ahead in the realm of finance and technology.