Malta Embraces Strengthened Investor Protection Rules: A Path to Financial Confidence

**EP and Council Strengthen Investor Protection Rules to Boost Confidence in Finance: A Malta Perspective**

In an age where financial markets are constantly evolving and globalisation is reshaping the economic landscape, the European Parliament (EP) and the Council of the European Union have taken significant steps to bolster investor protection rules. This move is particularly relevant for Malta, a nation that has positioned itself as a burgeoning financial hub in the Mediterranean. As the Maltese economy thrives on sectors like finance, technology, and tourism, enhanced investor protection measures are more than just regulatory updates; they are vital for maintaining and boosting confidence within the local and international investment community.

The recent amendments to the investor protection framework aim to provide a more robust set of rules designed to safeguard investors’ interests. This initiative is crucial for Malta, where the financial services sector contributes significantly to the national GDP. The country has seen a surge in foreign direct investment, particularly in fintech and digital currencies. However, as the landscape becomes more complex, so too does the need for stringent regulations that ensure investor security.

For many Maltese citizens, the implications of these updated regulations are profound. The local community has witnessed a shift towards financial literacy, with a growing emphasis on understanding investment risks and opportunities. As investor protection measures are strengthened, we can expect a ripple effect—enhanced consumer confidence will likely lead to increased participation in the financial markets. This is particularly important in a country where traditional savings methods are being challenged by innovative investment options.

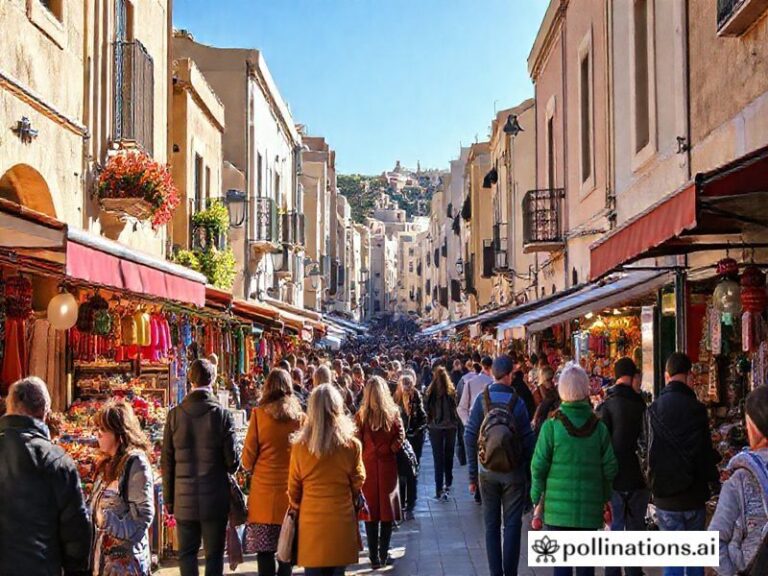

Moreover, Malta’s cultural significance in the Mediterranean cannot be understated. The island has a historical reputation as a trading hub, and its strategic location has long attracted merchants and investors from across Europe and beyond. By aligning its regulatory framework with EU standards, Malta not only reinforces its historical legacy but also positions itself as a modern-day leader in financial governance. The synergy between Malta’s rich trading history and contemporary regulatory measures helps foster a sense of pride among locals, who view these developments as a continuation of their heritage.

The community impact of these new regulations extends beyond mere economics. As investor protection becomes more robust, it encourages ethical investment practices. This is crucial for Malta, where the community values transparency and accountability. Enhanced regulations can lead to a more sustainable investment environment, promoting businesses that prioritize social responsibility and environmental stewardship. This aligns with the growing trend of socially responsible investing, which resonates deeply with the values of many Maltese citizens.

Furthermore, the updates will likely foster collaboration between local authorities and financial institutions. In Malta, the Malta Financial Services Authority (MFSA) plays a pivotal role in ensuring compliance with these new regulations. The strengthening of investor protection rules means that the MFSA will be better equipped to oversee financial entities, ensuring that they adhere to high standards of conduct. This collaborative approach not only enhances regulatory compliance but also builds trust between the government and the financial sector, which is essential for long-term stability.

As Malta continues to develop its financial services sector, it is imperative that the island remains vigilant in its approach to investor protection. By embracing these new regulations, Malta can ensure that it remains competitive on the global stage while safeguarding the interests of its citizens. The balance between innovation and regulation will be critical in navigating the future of finance in Malta.

In conclusion, the EP and Council’s recent measures to strengthen investor protection rules are a significant step forward for Malta’s financial landscape. By fostering confidence among investors and encouraging ethical practices, these regulations not only enhance Malta’s reputation as a financial hub but also enrich the local community. As the island continues to evolve, it is clear that a strong regulatory framework is essential for ensuring sustainable growth and prosperity.