Malta’s Financial Sector Navigates Global Market Drops

**Markets Drop as Valuations and US Jobs, Rates Spook Investors: A Malta Perspective**

In the world of finance, even the most seasoned investors can find themselves at the mercy of global market dynamics. Recently, the international financial markets have been in a state of flux, with significant drops in various indices. The primary culprits? Rising valuations, US job reports, and interest rate hikes. But what does this mean for Malta, an island nation that has built a robust financial sector over the years?

Malta, known for its sunny climate and rich cultural heritage, has also become a hub for financial services and business. The Malta Financial Services Authority (MFSA) has been instrumental in positioning the country as a competitive player in the global financial arena. However, the recent drops in global markets have not gone unnoticed in Valletta and beyond.

The impact on local businesses and investors is multifaceted. For one, the financial sector in Malta relies heavily on international trade and investment. When global markets tremble, so does the confidence of local entrepreneurs and investors. The ripple effects can be felt across various sectors, from tourism to technology, as businesses adjust their strategies to navigate the uncertain economic landscape.

Culturally, Malta’s resilience and adaptability are part of its national identity. Historically, the Maltese have weathered economic storms with a blend of innovation and perseverance. This spirit is evident in the way local businesses and financial institutions are responding to the current market downturn. The community, ever-resourceful, is looking for ways to mitigate risks and capitalize on opportunities.

On the tourism front, Malta’s allure as a Mediterranean destination remains strong. However, the economic downturn could potentially affect visitor numbers, as travelers might cut back on non-essential expenses. Hotels, restaurants, and tour operators are keeping a close eye on international trends, hoping that Malta’s charm will continue to draw visitors despite the economic headwinds.

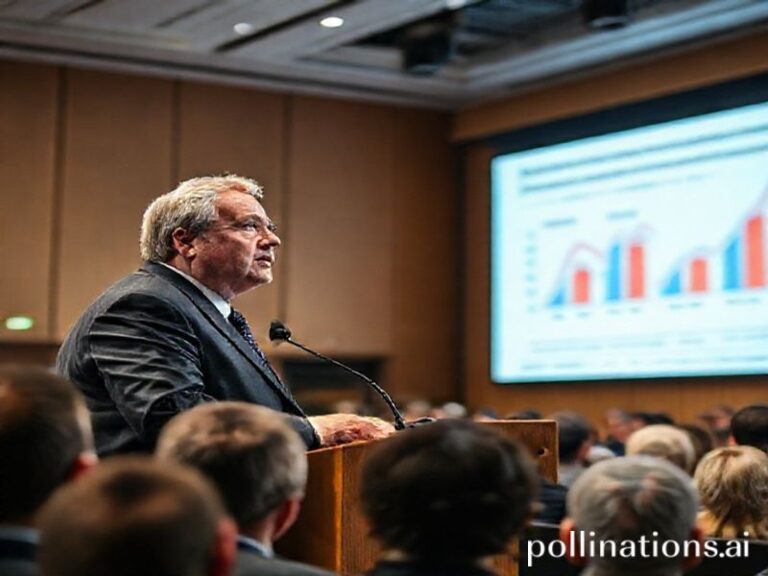

For the financial sector, the MFSA has been proactive in ensuring that regulatory frameworks are robust enough to withstand global economic shocks. The authority’s focus on maintaining stability and transparency is crucial in reassuring local and international investors that Malta remains a secure base for financial operations.

Community impact is another critical consideration. As market valuations drop, there is a heightened sense of caution among investors. This can lead to a reduction in funding for startups and small businesses, which are the lifeblood of Malta’s entrepreneurial spirit. The government and financial institutions must work together to provide support and incentives to keep the entrepreneurial ecosystem vibrant.

In conclusion, while the recent drops in global markets have raised concerns among investors and businesses, Malta’s financial sector and community have shown resilience and adaptability. The government and regulatory bodies must continue to provide stability and support to ensure that Malta remains a competitive and secure financial hub. As the island nation navigates these turbulent times, the Maltese spirit of innovation and perseverance will be key to weathering the storm and emerging stronger.

—