The Return of Gold in Malta: A Sign of Economic Uncertainty

### The Return of Gold: A Sign of Trouble in Malta

In the heart of the Mediterranean, Malta stands as a beacon of resilience and adaptability. Known for its rich history, vibrant culture, and thriving economy, the island nation has always been a symbol of prosperity. However, recent economic trends suggest a shift that might not bode well for the Maltese community. The return of gold as a significant asset is a harbinger of potential economic turbulence, and it’s essential to understand why this is happening and what it means for Malta.

Gold has long been a safe haven for investors during times of economic uncertainty. Historically, when traditional assets like stocks and bonds falter, investors turn to gold. This trend is becoming increasingly evident in Malta, where gold purchases are on the rise. The Maltese have traditionally been conservative investors, favoring real estate and stable financial instruments. The spike in gold purchases indicates a growing sense of unease among the populace.

The local context in Malta is particularly telling. The Maltese economy, while robust, has faced challenges in recent years, including the impact of the global financial crisis and the COVID-19 pandemic. These events have left many Maltese wary of economic stability. The return of gold as a popular investment is a clear signal that confidence in traditional financial markets is wavering.

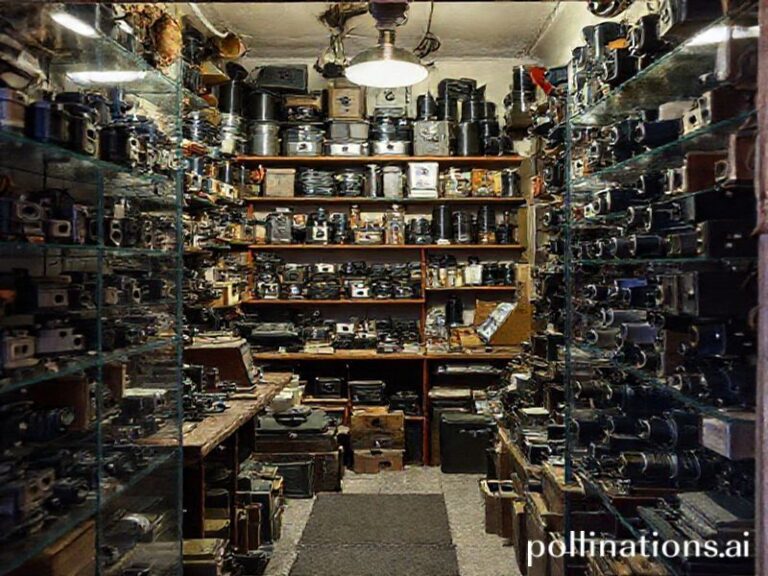

Culturally, Malta has a deep-rooted connection with gold. From the ancient Phoenicians to the Knights of St. John, gold has always been a symbol of wealth and power. In modern times, gold jewelry is a cherished part of Maltese tradition, often passed down through generations. The renewed interest in gold as an investment reflects a blend of cultural heritage and economic pragmatism.

The community impact of this trend is significant. As more Maltese people invest in gold, it signals a shift in financial priorities. There is a palpable sense of concern among the community, with many individuals and families seeking to protect their wealth against potential economic downturns. This trend also affects local businesses, as gold dealers and jewelers see an uptick in sales, while traditional financial institutions may face increased scrutiny.

Experts warn that the return of gold as a primary investment vehicle is not without its risks. Gold prices can be volatile, and while it offers a hedge against inflation, it doesn’t provide the same growth potential as other investments. The Maltese government and financial regulators are closely monitoring these trends, with some calling for increased financial literacy programs to help citizens navigate these uncertain times.

In conclusion, the return of gold in Malta is a complex phenomenon that intertwines economic trends, cultural heritage, and community sentiment. While it may offer short-term security for investors, it also signals underlying concerns about economic stability. As Malta navigates these challenges, it is crucial for policymakers, financial institutions, and the community to work together to ensure a resilient and prosperous future.